Fashion brands offering affordable, functional clothing are gaining momentum in South Korea, reshaping the country’s apparel market and challenging long-dominant players.

E-Land World Co. (E-Land), operator of brands including SPAO and New Balance Korea, posted the highest operating profit in the domestic fashion industry last year, overtaking the so-called “Big Five”: Samsung C&T Corp.’s fashion division, LF Corp., Handsome Corp. (a Hyundai Department Store affiliate), Shinsegae International Inc., and Kolon FnC.

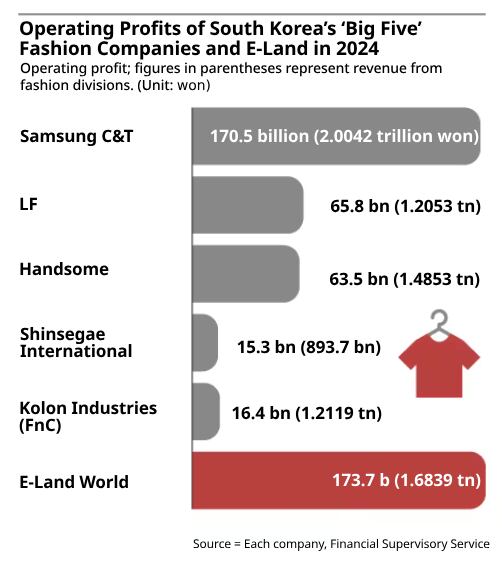

E-Land’s fashion division reported an operating profit of 173.7 billion won ($122 million) in 2024, narrowly ahead of Samsung C&T’s 170.5 billion won ($119 million) and well above LF (65.8 billion won), Handsome (63.5 billion won), Kolon Industries Inc. (16.4 billion won), and Shinsegae International (15.3 billion won), according to Financial Supervisory Service data and industry sources. Excluding companies focused on intellectual property (IP)-based brands like F&F Co., E-Land is now effectively the sector’s most profitable player.

Driven by demand from value-conscious consumers, retailers across South Korea are expanding low-cost apparel lines. Daiso, a popular lifestyle chain, recently introduced T-shirts priced at 3,000 won and sweatpants at 5,000 won. Convenience store chain 7-Eleven followed with a private-label T-shirt at 9,900 won, while online fashion platform Ably Corp. added a dedicated category for fast fashion brands such as SPAO and TopTen amid growing demand.

E-Land’s domestic fashion revenue reached 1.6839 trillion won ($1.1 billion) in 2024, trailing Samsung C&T’s 2.0042 trillion won ($1.4 billion) but surpassing Handsome (1.4853 trillion won), Kolon FnC (1.2119 trillion won), and LF (1.2053 trillion won). It marked E-Land’s fifth consecutive year of sales growth.

The company operates a portfolio of value-driven brands including SPAO, New Balance Korea, MIXXO, and WHO.A.U. SPAO led the group’s performance last year, generating 600 billion won ($419 million) in sales. Launched in 2009 as a homegrown alternative to Japan’s Uniqlo, SPAO built a following among middle-income shoppers with affordable basics such as T-shirts, jeans, shirts, and sleepwear, becoming especially popular with teenagers and young adults.

SPAO has since broadened its appeal by investing in R&D and promoting practical features like “easy to wash” and “high sweat absorption.” New offerings—including padded jackets for 69,900 won and fleece pullovers at 29,900 won—helped diversify its lineup. Annual revenue rose from 320 billion won in 2021 to over 600 billion won in 2024, maintaining average annual growth of around 20%.

Seeking to replicate SPAO’s success, E-Land is extending its value-focused strategy to other brands. Earlier this year, its retail subsidiary E-Land Retail Co. launched NC Basic, a new fast fashion label built on the company’s cost-saving production model, with its fashion units jointly outsourcing manufacturing to factories in Vietnam and Myanmar. NC Basic currently offers about 130 products—including clothing, underwear, activewear, and accessories—all priced below market averages. Popular items include backpacks for 15,900 won, jeans for 19,900 won, and windbreakers for 29,900 won.